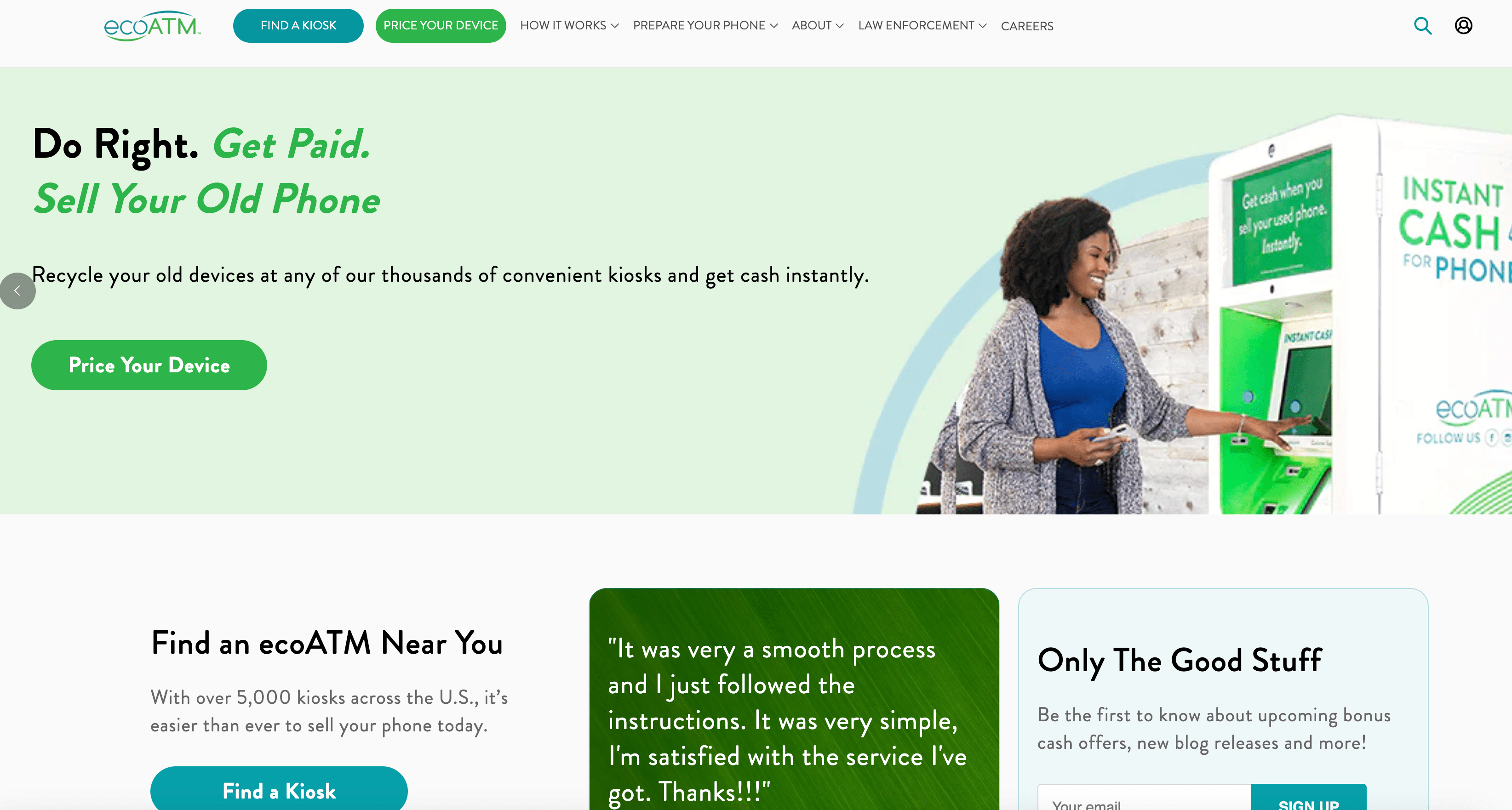

Top 10 Opportunities to Trade Your Old Electronics for Money

Are countless old tech devices like phones, gaming consoles, and tablets cluttering your space? Today, it’s a breeze to dispose of these electronics and earnmore...

Revamping Your Credit Score After Foreclosure: An 8-Step Guide

Losing your home to foreclosure is devastating, and it also has severe indirect financial consequences. Foreclosure can lead to a decline of your credit scoremore...

Understanding Private Mortgage Insurance (PMI) and Ways to Avoid It

Are you noticing an entry marked “PMI” on your monthly mortgage statements? If so, you are paying for private mortgage insurance. The relevance, cost, andmore...

Maximizing Retirement Contributions in 2024

The Internal Revenue Service (IRS) has announced an increase in the individual contribution limits for 401(k) plans in 2024, allowing individuals to contribute up tomore...

How to Lower Capital Gains Taxes on Stock

Stock investors should consider capital gains tax. Capital gains are realized when you sell an item for more than you paid. You have earned amore...

Transitioning Retirement Investments: From Tax-Deferred to Taxable Income Strategies Before 2026

In the next few years, Roth IRAs that are tax-free now will gain in popularity. I'll explain. The Tax Cut and Jobs Act of 2017more...

Mastering the Art of Making Money on TikTok

TikTok, the rapidly growing and cutting-edge social media platform, has captured the attention of users across all age groups. Whether you're a camera-savvy influencer ormore...

Amazon Gift Cards: Effortless Ways to Earn for Your Shopping Spree

It's astonishing how you can effortlessly score Amazon gift cards through various means. With these free gift cards, you practically have the power to purchasemore...

Quantifying Excessive Credit Card Debt

I won't stand here pretending to be holier than thou when it comes to debt issues. Credit card debt has been a persistent adversary inmore...

Roth IRAs for Children: Make your child a millionaire

Why plan for retirement at such a young age? This is an excellent question. Many people don't even begin to think about retirement until theymore...