In the realm of personal finance, certain pieces of advice are often touted as gospel truth. However, upon closer examination, some of these widely accepted notions might not hold water.

1. The Myth of “Good Debt”

Repeatedly, we hear the mantra that to have a good credit score, you must carry debt. This financial advice, however, is fundamentally flawed.

The concept of “good debt” is essentially non-existent. Debt, by definition, entails owing money to someone else, and that’s never a positive situation. While it’s true that certain debts, like those incurred for a home or car, may be deemed necessary, labeling them as “good” is misleading.

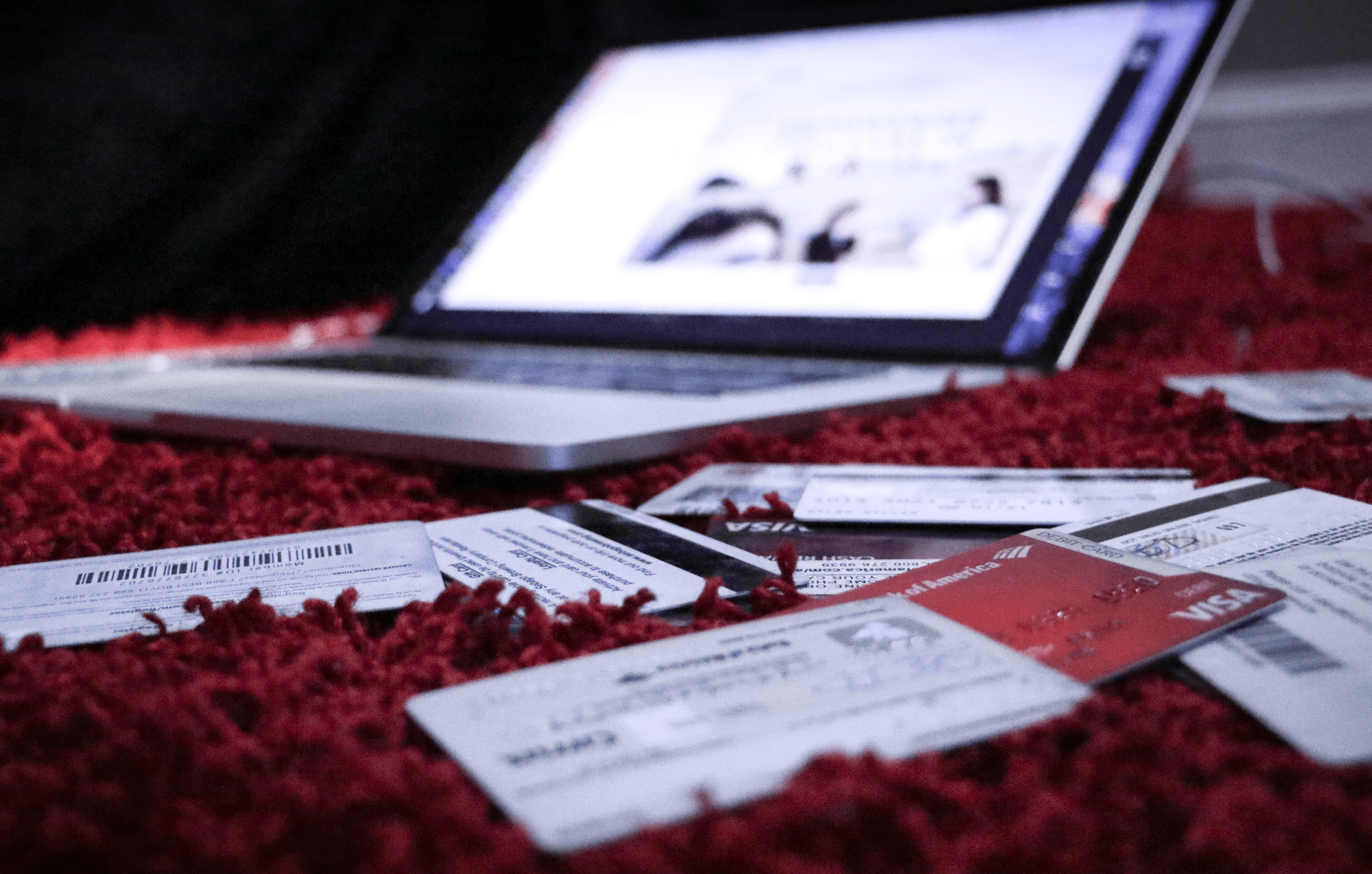

Credit card debt, on the other hand, should never fall into the category of acceptable debt. Carrying a balance on your credit card that you cannot pay in full every month is a financial misstep that should be avoided.

2. Emergency Funds vs. Credit Cards

The narrative that a credit card is a crucial tool for emergencies is a common one. While it’s wise to be prepared for unforeseen circumstances, relying solely on credit cards for emergencies can create a financial quagmire.

Instead, consider the prudence of having a fully-funded emergency savings account. Knowing you have cash readily available to tackle unexpected expenses provides a sense of security, unlike relying on credit cards and accruing debt in times of crisis.

3. The Leasing Dilemma: Renting Cars

The idea of leasing a car is often presented as a savvy way to drive a new vehicle every few years. However, when examined closely, leasing can be a financial trap.

Paying $300 per month for a leased car means shelling out nearly $11,000 over three years with nothing to show for it when the lease term ends. Instead, consider purchasing a reliable used car. By saving the equivalent monthly payment, you could accumulate the funds to pay for a new car in cash when the time comes.

4. Renting is Money Wasted: The Housing Conundrum

The notion that renting is equivalent to throwing money away is a common belief, but it doesn’t hold true for everyone.

In situations where a substantial down payment is not feasible, or when future relocations are anticipated, renting might be a pragmatic choice. It allows for flexibility without the added responsibilities of homeownership, such as maintenance costs and property taxes.

It’s crucial to assess your budget and individual circumstances to determine whether renting or buying aligns with your financial goals.

5. Always Opt for a Brand-New Car

Television ads often entice viewers with low-interest payment plans, creating an allure for brand-new cars. However, the financial wisdom of buying a new car requires scrutiny.

New cars experience their steepest depreciation in the first few years. Choosing a slightly used vehicle with lower mileage can significantly reduce the cost of ownership while still providing reliable transportation. This approach allows you to allocate your budget more efficiently.

6. The College Conundrum: Do You Always Need a Degree?

The prevailing belief that everyone must attend college immediately after high school is a perspective that merits reconsideration. Not all careers necessitate a traditional college education, and accumulating student loan debt without a clear plan can lead to financial strain.

Exploring vocational schools or gaining work experience before committing to higher education is a valid approach. It’s essential to have a passion and a clear understanding of your goals before embarking on a costly educational journey.

In conclusion, while seeking financial advice from family and friends can be valuable, it’s crucial to critically evaluate common notions. Blindly following advice without conducting personal research can lead to increased debt and financial setbacks. Approach financial decisions with a discerning eye, and tailor your choices to align with your unique circumstances and goals.

+ There are no comments

Add yours