Investing in real estate presents a lucrative opportunity to build wealth, and contrary to common misconceptions, it doesn’t always require substantial capital. Despite the belief that real estate is reserved for the wealthy, there are various approaches that cater to different budgets, ranging from $10 to $100,000. Let’s explore six accessible ways to enter the real estate market.

1. Shallow Analysis and Real Estate’s Five Wealth-Building Strategies

Before delving into specific investment methods, it’s crucial to understand the nuanced wealth-building strategies of real estate. Unlike stocks, real estate’s appreciation is just one facet of its wealth creation. Rent, not appreciation, emerges as the cornerstone of real estate strength.

By analyzing cumulative rents and house values in comparison with stocks, it becomes evident that real estate consistently outperforms stocks, providing smooth and stable returns. It’s essential to move beyond superficial analyses and recognize the long-term value of rental income.

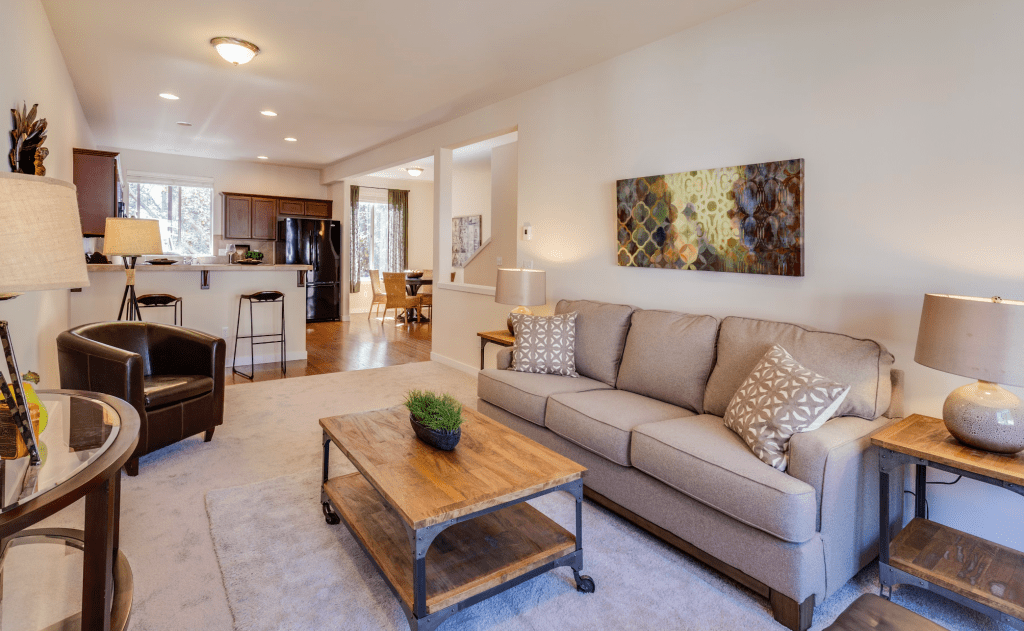

2. “Stepping Stone Approach” – Rent Out Your Old Home

For those with a modest budget (starting under $20,000), the “Stepping Stone Approach” allows you to unintentionally become a landlord. By renting out your previous residence when upgrading, you enter the realm of real estate investment without significant upfront costs. Focusing on high-rent areas ensures your rental income covers mortgage expenses and other outlays, making it a viable strategy.

3. Live-In Flip – Starting at $30,000

The Live-In Flip strategy involves purchasing a house that needs improvements but is livable. Living amidst renovations might be challenging, but the potential tax-free profits make it appealing. Calculate the after-repair value, estimate the rehab budget, and negotiate terms based on profit targets. With an initial investment of around $30,000, you can leverage this low-risk approach to real estate, especially considering the tax advantages.

4. “Turnkey” Property Investment – Costs Range from $30,000 to $50,000

For those seeking a hassle-free investment, turnkey properties offer a solution. Priced between $50,000 and $100,000, turnkey investments involve companies handling property analysis, acquisition, and management. However, the risks associated with high prices and potential conflicts of interest with property management companies should be carefully considered.

5. Partnering with Other Investors – Startup Cost: $25,000 – $100,000+

Partnering with other investors is an excellent way to diversify your real estate portfolio without delving into intricate details. Whether through house flipping, renting multifamily housing, or commercial and apartment building syndication, partnering allows you to pool resources and expertise. Networking and attending local investor meetings are crucial for finding reliable partners.

6. Crowdfunded Real Estate – Initial Investment: $1,000 to $20,000

Crowdfunding has emerged as an innovative way to invest in real estate projects collectively. While requiring accreditation, crowdfunding platforms enable investors to join forces with relatively small amounts, starting from $1,000. These platforms conduct due diligence, mitigating risks, but potential investors must be aware of accreditation requirements and associated fees.

7. Real Estate Investment Trusts (REITs) – Minimum Investment: $10?

For those seeking a hands-off approach, REITs offer a way to invest in real estate without directly owning properties. Public exchange-traded REITs, private REITs, and public non-traded REITs provide varying levels of liquidity, returns, and risks. Fundrise, a crowdfunding platform, offers an entry point with low minimum investments and diverse real estate opportunities.

Understanding these diverse approaches to real estate investment allows potential investors to align their strategies with their financial capacities, risk tolerance, and investment goals. Whether you’re an accidental landlord, a DIY enthusiast, or prefer a passive investment, there’s a real estate avenue suited for you. Research thoroughly, stay informed, and consider seeking professional advice before embarking on your real estate investment journey.

+ There are no comments

Add yours